22 January 2024

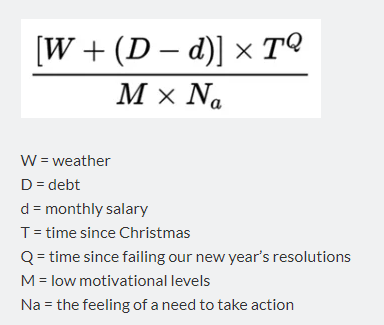

As we approach the final week of January, I pause to think about how my resolutions are going…

Let’s recap my quartet of intentions:

Saving money: aiming for £400 per month

January brings the annual tax bill when I have to pay back most of my Child Benefit in one of the UK’s harshest penalties against those is us not living in happy coupledom. (Even the Tory Chancellor, as recently reported in many media, recognises the unfairness ”There is a very big distortion in the marginal rate of tax that people earn and I fully accept there is an unfairness with what happens with dual income families” ). Fortuitously though, as I log in to pay my dues this year, I am pleasantly surprised to find a tax refund sitting on my account.

Scarcely has the good fortune sunk in however, before two unexpected costs hit the family budget.

Small boy, hurtling rapidly towards his 18th birthday, suddenly realises that, to make the most of his newly found adulthood in our local hostelries, he needs ID and his passport has expired. So I have to find £82.50 to apply for a new one.

And, on a far less cheery note, prepped and crammed with chemistry facts, my nervous son also attends a university interview at his institution of first choice and …it is awful. I am tempted to name and shame the establishment but, unlike the arrogant, asinine specimens who interview him, I do have a shred of integrity and professionalism, so shall refrain. Their behaviour is absolutely disgusting, laughing at my child’s answers, making cheap jibes and leaving him shell shocked and demoralised. It takes a lot of time to help him get over this … and I am also forced to blow the strict food budget on an emergency recovery take-away!

So financial ups and downs but, with a week to go, I think I might just scrape it, which is a great start to a year of saving.

Buying a nice item for the foodbank as part of my weekly shop

This one is a big tick. I love deciding what to buy each week. Plus, as I add my offerings to the crammed foodbank crate, it a gloriousreminder that there are a lot of kind folk in this world and that together our small acts do combine to make something of significance.

Running/walking at least a mile a day in January

Ughh … what a chore! I completed this challenge a few years ago and breezed through it, but looking back, that was a January in semi-lockdown, when working partially from home and having absolutely nothing to do with any evening made things a lot easier. Roll onto the busyness of 2024 and already I have given up on Wednesdays when late night meetings, grabbing food and dashing off to orchestra mean that I can’t even think about exercise until 10pm and … who wants to be lacing up their trainers at that hour?

Then there is the weather; dark and snowy. On two occasions, I narrowly avoid being run over by cars coming out of their drives without looking. On another icy evening I fall flat on my ‘posterior’ – ouch! And on slippy Saturday, grinding around the local woods with my run buddy, we are moving so slowly that she eventually starts walking and overtakes me, with a parody of the famous Harry Enfield jockey sketch , “Hello … how are you?” That run gets abandoned, as we collapse in laughter and decided tea and cake is a much better way to spend the morning.

Thank the Lord, there are only 9 more days to go

Taking part in Bloganuary

Last but by no means least. This is an utterly fabulous resolution! The daily prompt actually makes me enjoy waking up each morning, a creativity boost that even beats caffeine! (See my Bloganuary page for the full set of … pretty random thoughts!)

So, all in all, I think I am doing OK and in any case, it has all kept me so busy that I’ve scarcely had time to bemoan the misery of January this year. So here’s to resolutions…